Welcome

Hi! I am so excited that you have decided to visit my site. I know that your home financing is a big deal, likely the biggest decision you will make in your life, and I appreciate the trust you put in me when you decide to work with me. Whether you are looking to buy your first home, or you are looking to move from the home you are currently in or even to simply get a mortgage check up on your current mortgage, you can feel confident knowing that I will listen to your goals, needs and concerns, and do my very best to address every one of them. I truly care about your financing and get almost as excited as you when you get the keys to your new home.

Your Mortgage Experience

Step 1: Review your budget and start saving for a down payment

Step 2: Complete your application and provide the consent and required documents

Step 3: Review options and decide which product is best for you and your financial goals

Step 4: Start house hunting-need a realtor referral? I can help with that

Step 5: Make a conditional offer, application submitted to the lender

Step 6: Satisfy the requirements of the lender and protect your family with life/disability/home and fire insurance

Step 7: Get a home inspection

Step 8: Remove all conditions (once given the go ahead), then meet with the lawyer or signing officer

Step 9: Take possession or close your new mortgage!

Calculate your cost

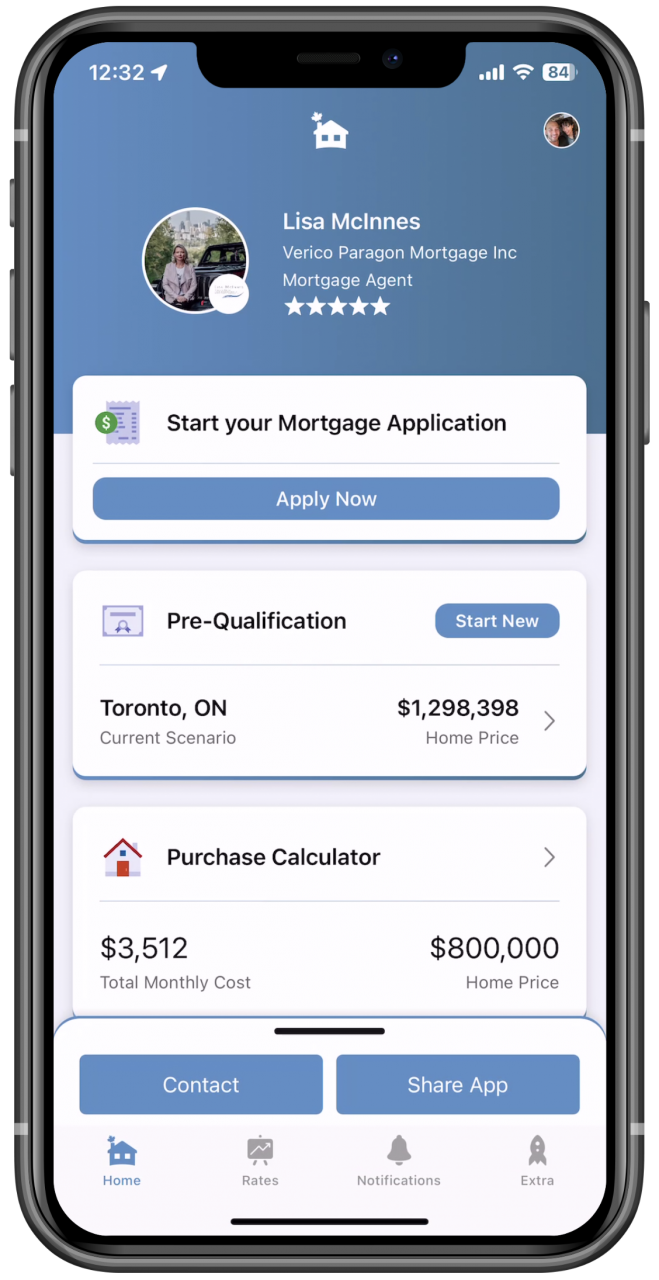

Download my mobile App and get Pre-Qualified

Easily calculate your total home ownership cost, the stress test, compare rates by national and regional lenders and brokers, calculate land transfer taxes and determine your affordability to the penny.

Not Your Average Broker

I began brokering in 2009 after experiencing a traumatic incident with a big bank that left my family vulnerable. I ended up working with a mortgage broker/friend who was able to fix our problems. This inspired me to also want to help others with their mortgage needs in a way that would always put them in the best possible situation.

I specialize in getting the lenders competing for your business on your very first mortgage as well as again when you’re approaching your renewal date. I can also help you access home equity through a refinance or home equity line of credit – to free up cashflow, pay off debt, renovate your home, buy an investment property, send kids to school or find added funds for whatever you need.

Because of my keen eye for detail and drive to always ensure I have the most streamlined systems in place at all times, I also enjoy guiding brokers in implementing best practices to improve their businesses. And when it comes to brand new brokers to the industry, I take pleasure in mentoring and coaching them to ensure they have the support they need to help guide clients in the right direction as well. Have questions about your mortgage options? Answers are just a phone call or email away!